For recruitment agencies using umbrella companies (employment intermediaries) to payroll temp workers the Chancellor has a message

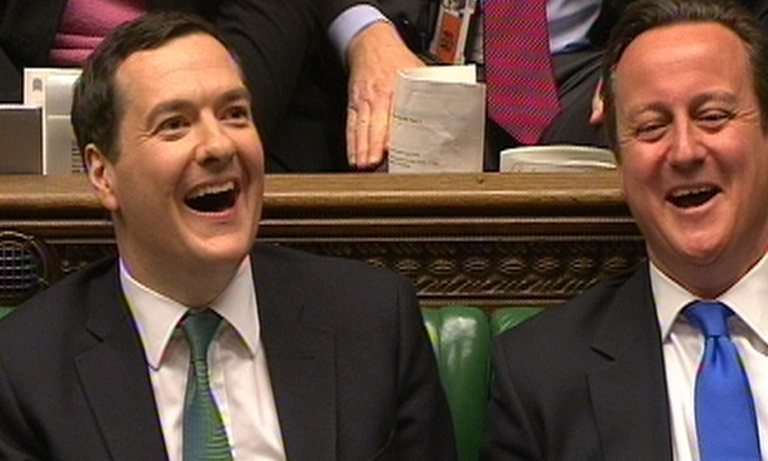

For recruitment agencies using umbrella companies (employment intermediaries) to payroll temp workers the Chancellor has a messageChancellor George Osborne has delivered his comprehensive spending review and Autumn Statement with the full details published here.

For recruitment agencies using umbrella companies (employment intermediaries) to payroll temp workers the Chancellor has this message:

3.20 Employment intermediaries and tax relief for travel and subsistence – As confirmed at Summer Budget 2015, the government will legislate to restrict tax relief for travel and subsistence expenses for workers engaged through an employment intermediary, such as an umbrella company or a personal service company. Following consultation, relief will be restricted for individuals working through personal service companies where the intermediaries legislation applies. This change will take effect from 6 April 2016.

3.87 Disguised remuneration – The government intends to take action against those who have used or continue to use disguised remuneration schemes and who have not yet paid their fair share of tax. The government will also consider legislating in a future Finance Bill to close down any further new schemes intended to avoid tax on earned income, where necessary, with effect from 25 November 2015.

Details around how this will all be achieved remain to be published, meaning its true effect on recruiters will play out over the coming months.

Also from the statement:

State of the economy

UK fastest growing economy in the G7

3% growth forecast in 2014, up from 2.7% predicted in March

2.4% growth forecast in 2015, followed by 2.2%, 2.4%, 2.3% and 2.3% in the following four years

500,000 new jobs created this year. 85% of new jobs full-time

Unemployment set to fall to 5.4% in 2015

Inflation predicted to be 1.5% in 2014, falling to 1.2% in 2015

Education & Jobs

The Business Secretary is to create a new business-led body to set standards for apprenticeships.

£10,000 loans for postgraduate students studying for masters degrees

Employment Allowance worth £2,000 extended to carers

Research and development tax credit increased for small and medium-sized (SMEs) firms

National Insurance on young apprentices will be abolished

Chris Jones, Chief Executive, City & Guilds Group

“We are pleasantly surprised by the Chancellor’s commitment to professional and technical education and his recognition that this is essential to our economy. Although apprenticeships are important, they will not solve the nation’s skills shortages in isolation. We need a holistic commitment to professional and technical education to achieve the Government’s commitment to one million new jobs. Perhaps this is a start, but time will tell.

“We welcome the protection of the adult skills budget, the investment in University Technical Colleges and provision of loans to help individuals develop their skills. This commitment needs to be maintained.”

On the apprenticeship levy:

“With annual productivity gains from training an apprentice averaging £10,280 per year, continued investment in apprenticeships makes sense. But the real challenge is increasing the number of high-quality apprenticeship placements and for that we need a sustainable, long-term funding solution.

“The levy could be that solution, but it will only be successful if employers support it. The Government needs to get the right balance between rigour and bureaucracy to make sure employers create quality apprenticeship places.”

On infrastructure / devolution:

“The Government’s investments in the UK’s infrastructure and housing is welcome. But such large-scale projects will depend on skilled workers to ensure they are delivered to a high-standard, on time, and on budget. Skills gaps pose a huge barrier to the Government’s ambitions.

“We welcome the Government’s move to give local communities and cities more decision-making power around how they spend their skills budgets. It will help align the skills system to the local job markets, such as the job opportunities that these infrastructure projects create. Councils need to work with their Local Enterprise Partnerships to strengthen the link between education and employment.”

Lee Biggins, founder and managing director of CV-Library.co.uk:

“Devolving power to local councils is a critical step in building up the Northern Powerhouse and boosting employment across the nation. Our latest data revealed that 2016 is already set to bring improved career opportunities outside of London with cities such as Liverpool, Edinburgh, Cardiff and Hull topping the list for job growth in 2015.”

“However there is still a lot that the government needs address if other cities are going to successfully mirror the scale of work available in London. Councils need to have more control over decisions that affect their regions; a devolution deal in today’s autumn statement would definitely be a step in the right direction.”

For businesses and business owners

The apprenticeship levy introduced in April 2017 to be set at 0.5% of an employers’ pay bill and will be paid through PAYE. The Chancellor stated that every employer will receive a £15,000 allowance to offset against the levy – which means over 98% of all employers – and all businesses with payroll bills of less than £3 million – will pay no levy at all.

Action is promised on disguised remuneration schemes, stamp duty avoidance, and preventing the abuse of intangible fixed-assets regime and capital allowances.

On T&S where the workers are engaged through an intermediary: “… the government will legislate to restrict tax relief for travel and subsistence expenses for workers engaged through an employment intermediary, such as an umbrella company or a personal service company.”

Personal service companies must watch this space: Following consultation, relief will be restricted for individuals working through personal service companies where the intermediaries legislation applies. This change will take effect from 6 April 2016.

A year’s extension of the Small Business Rate Relief Scheme to April 2017

Some new enterprise zones where small firms pay reduced taxes and get business support. 7 zones somewhere in the ‘Northern Powerhouse’.

Support extended to small businesses with £500m of bank lending plus £400m government-backed venture capital funds which invest in SMEs

Get The Recruiting Times FREE every Monday – SUBSCRIBE NOW

Recruiters love this COMPLETE set of Accredited Recruitment & HR Training – View Training Brochure