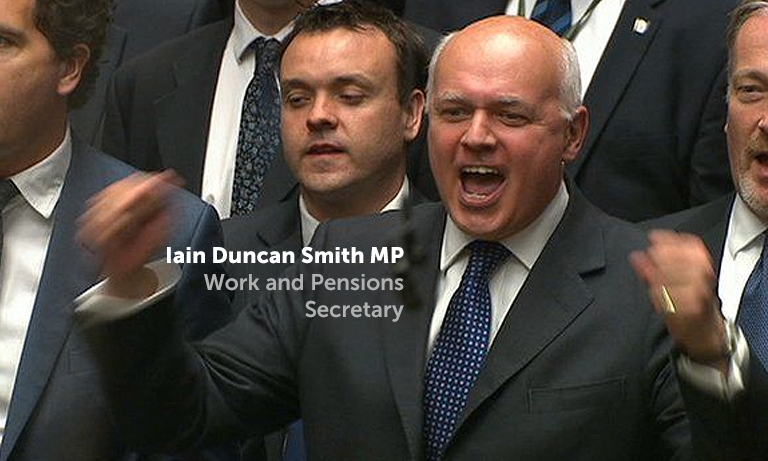

Iain Duncan Smith was appointed Secretary of State for Work and Pensions in May 2010

Iain Duncan Smith was appointed Secretary of State for Work and Pensions in May 2010Around 28,000 people who have had their benefits capped have moved into work, reduced their Housing Benefit claim or no longer claim Housing Benefit, according to new figures.

The benefit cap, which continues to provide a clear incentive to work, limits the amount of benefits a household can receive to a maximum of £26,000 a year, the equivalent of an annual salary of £34,000.

The figures come as the UK’s labour market enjoys strong growth – with a record number of people in work and wages continuing to rise. The number of vacancies has also risen to almost 740,000, higher than before the recession, providing more opportunities for people to move off benefits and into work.

Under new measures announced earlier this year, the benefit cap will be reduced to £23,000 in Greater London, and £20,000 elsewhere in the country, better reflecting the circumstances of many hardworking families.

Work and Pensions Secretary, Iain Duncan Smith, said:

“At their core our welfare reforms have been about supporting people back to work, and restoring fairness to the benefits system.

“The benefit cap is a vital cornerstone because it ends the perverse trap that used to exist – where it was often more worthwhile to remain on benefits than go out to work. This single reform ensures that people are always better off in employment, and thereby acts as a powerful incentive to move into work.

“Today’s figures show its success, with significant numbers of people doing just that – taking advantage of the near record numbers of opportunities available in the UK economy.”

Since the cap was introduced in April 2013, around 67,000 households have had their benefits capped. 43,500 of those households are no longer subject to the cap, with 18,100 of them moving into work, and a further 9,800 reducing their Housing Benefit claim, or no longer claiming Housing Benefit at all.

Before the cap, there was no upper limit on benefit claims, with 300 of the highest claiming families getting over £10 million in benefits every year.

To increase the incentives for claimants to move into work, households where someone is entitled to Working Tax Credit are exempt from the benefit cap. All households with someone, including a child, in receipt of a disability-related benefit are also exempt from the benefit cap recognising the extra costs disability can bring.

The government has also provided local authorities with £500 million of funding to support people transitioning to our welfare reforms, with a further £800 million to be provided over the course of this Parliament.

Get The Recruiting Times FREE every Monday – SUBSCRIBE NOW

Recruiters love this COMPLETE set of Accredited Recruitment & HR Training – View Training Brochure